Average UK rents fell by 0.8% between April and June, according to our quarterly Rental Market Report.

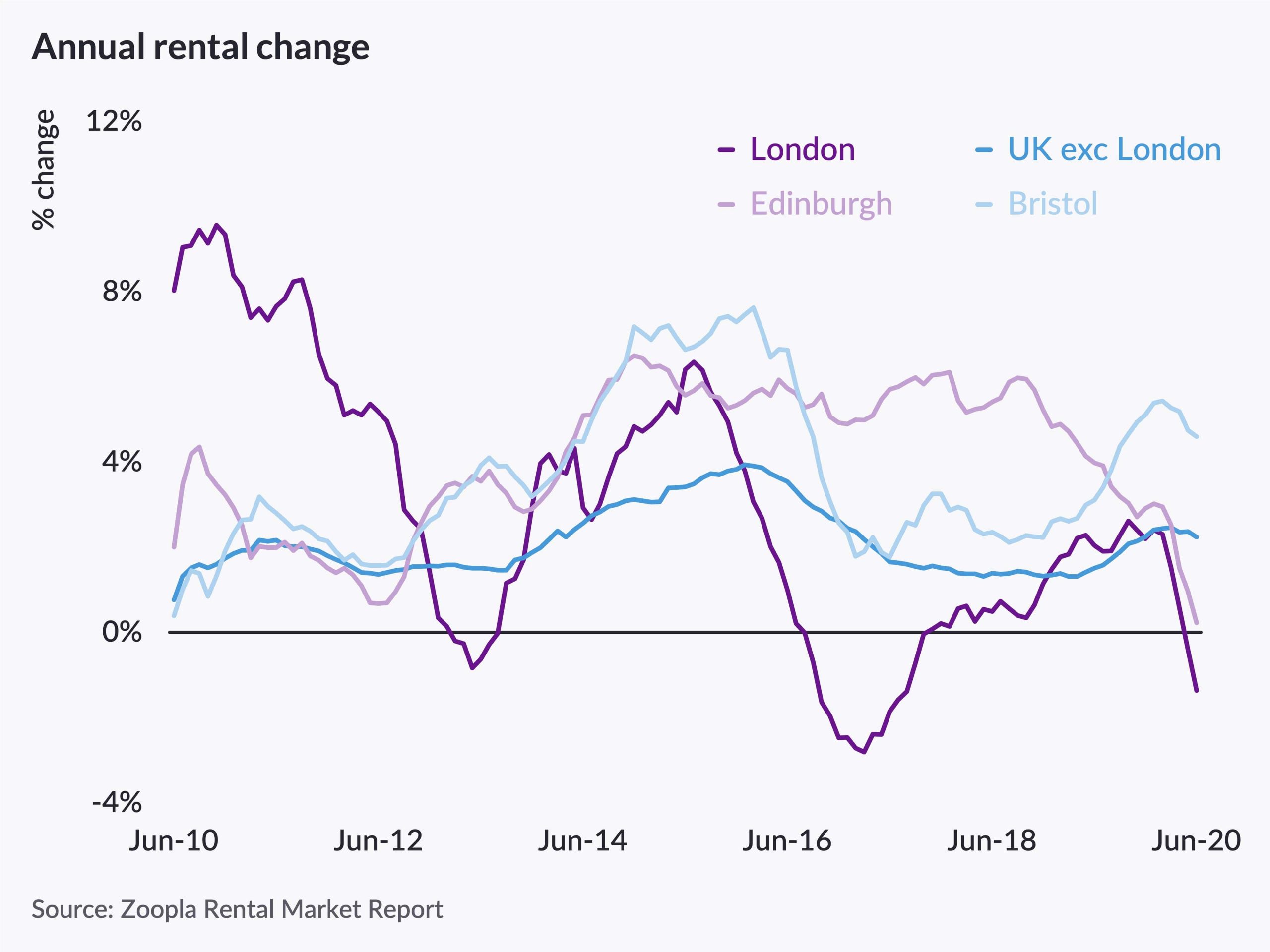

This takes the annual growth rate in rents to 1.1%, down from 1.7% a year ago.

However, a two-speed market is emerging, with rental growth actually up across regions outside of London.

Where are rents rising and falling?

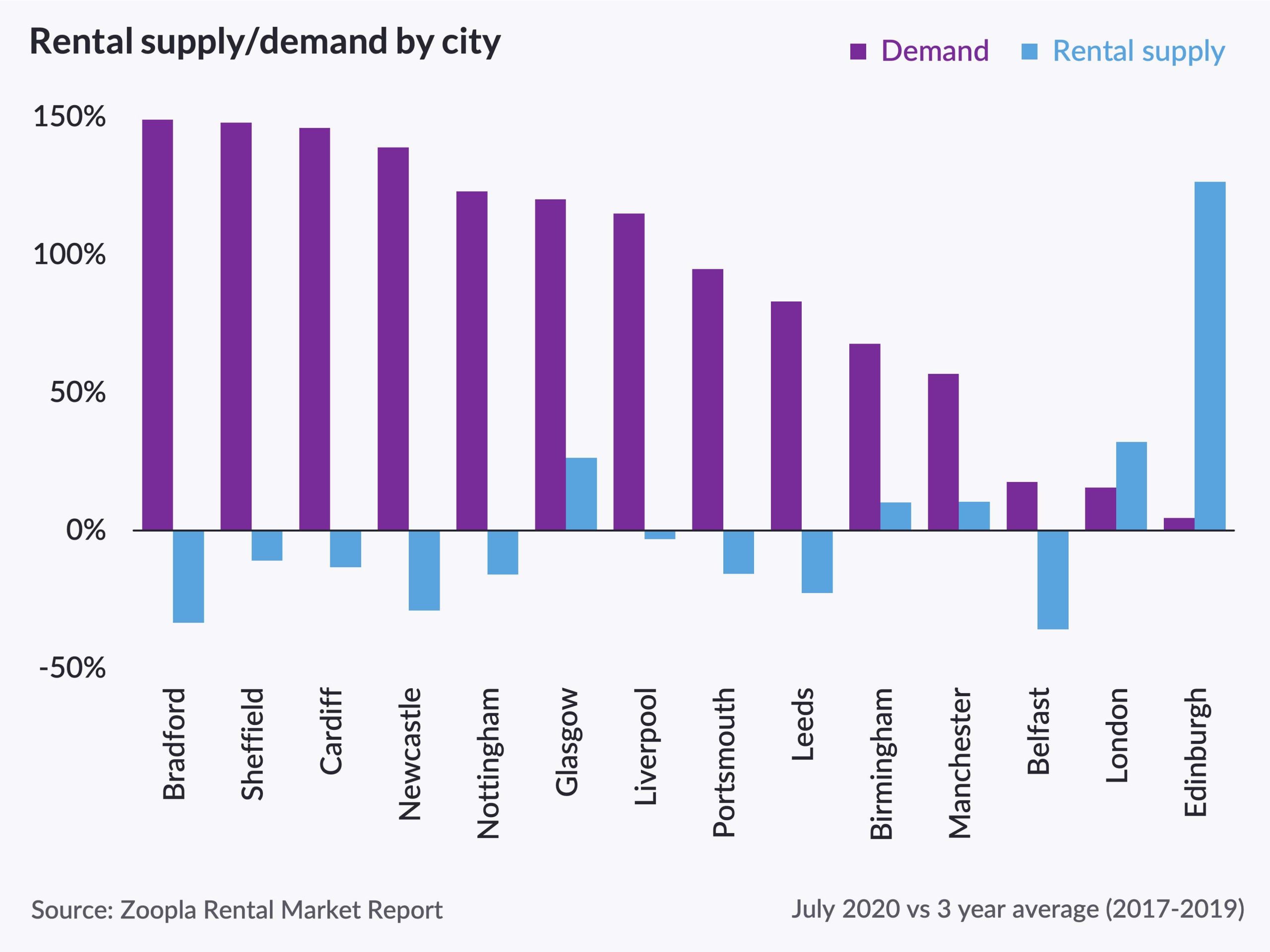

The two-speed rental market is being driven by diverging trends in supply and demand between London and the rest of the UK.

Annual rental growth – excluding London – is up 2.2% as demand continues to outstrip supply in many markets. It ranges from 1.5% in the West Midlands, through to 3.1% in Wales.

Only six of the 64 towns and cities tracked by the rental index have shown rental falls in the past year (Swindon, Coventry, Middlesbrough, Northampton, London and Aberdeen), with a further six registering growth over 4% (Rochdale, Sunderland, Bristol, Preston, York, Leicester).

But a rise in the number of homes for rent in London and Edinburgh, which is increasing choice for renters, is not being matched by similar levels of demand. And this is leading to downward pressure on rents and the rate of rental growth in these two cities.

London

London

Increasing supply and weaker demand in the capital have meant that rents have fallen 3% since the start of the year, and they have dropped 1.4% over the last 12 months.

The greatest downward pressure on rents has been seen in the heart of London, where the working from home policy and a clampdown in travel and tourism during lockdown have hit demand for rental property.

This is the second time rents have gone into negative territory in London in the last three years. In March 2017, rents were down 2.8% on the year after the 3% stamp duty surcharge was introduced in 2016.

Edinburgh

Meanwhile, annual rental growth in Edinburgh, the second most popular tourist destination in the UK, has slowed to 0.2%, down from 4% a year ago, as declining tourism and policy changes take their toll on landlords and the supply of homes for rent.

What is rental demand like?

What is rental demand like?

Overall demand for rental homes is running 33% higher than pre-lockdown levels, and 25% above 2019 levels across the UK.

It’s likely to have been driven by pent-up demand from renters whose plans were put on hold during the housing market shutdown, plus other renters who may have used lockdown to reassess their home and lifestyle.

At the same time, the number of homes for rent has climbed since lockdown ended. It is now slightly ahead of seasonal trends, with the volume of homes for rent across the UK up 7% on this time last year.

How affordable is renting at the moment?

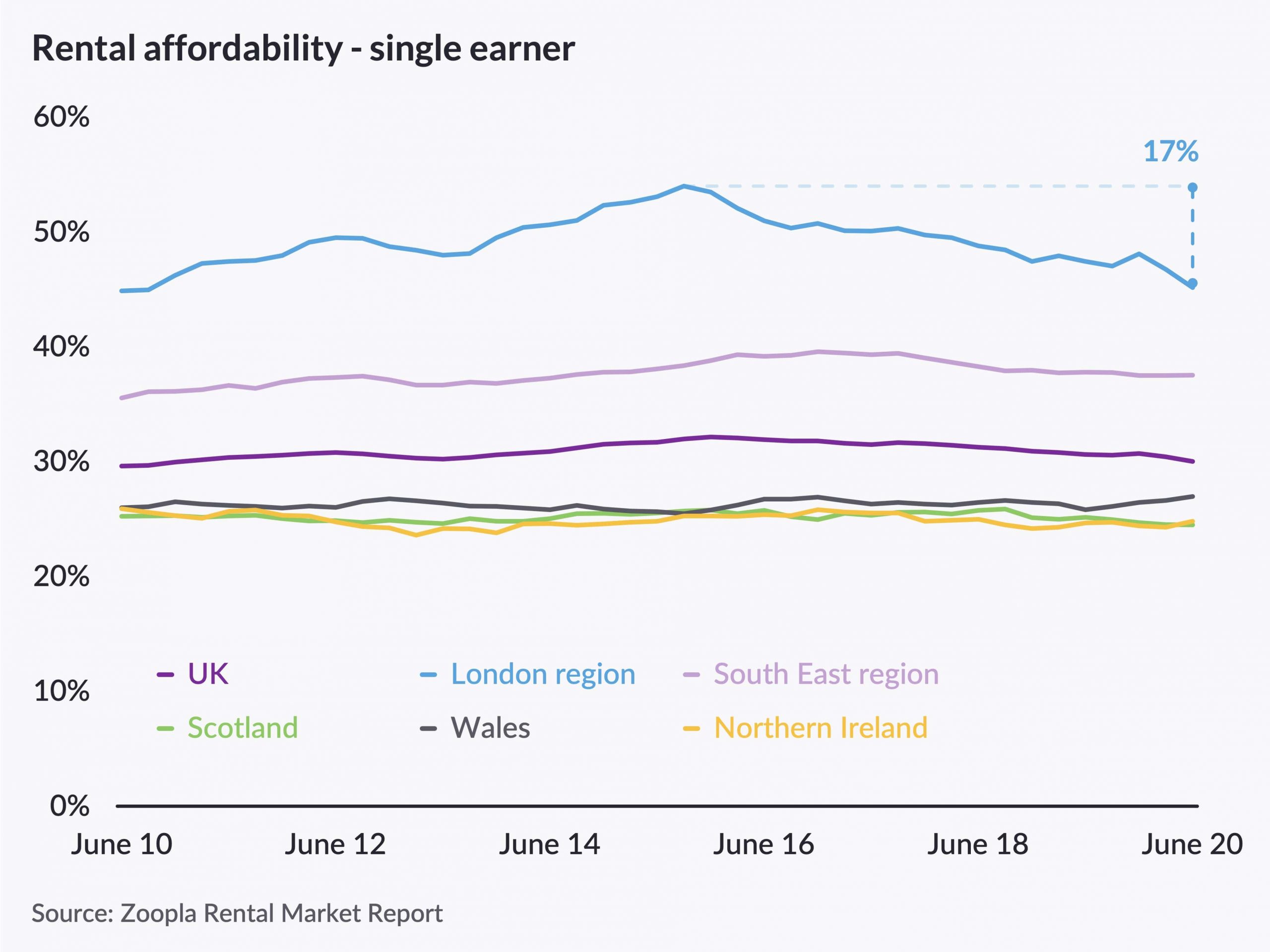

Affordability has remained largely unchanged in recent years, except for in London, where the proportion of income needed to cover average monthly rents has fallen to 45% from 54% in September 2014.

Perhaps unsurprisingly, the capital remains the most expensive region in the UK in which to rent a home.

What can we expect for the rest of 2020?

What can we expect for the rest of 2020?

Zoopla Research expects annual UK rental growth outside London to halve from 2.2% to 1% by the end of the year, with an annual decline in London of up to 5% by the end of 2020.

Gráinne Gilmore, head of research, explained: “The future path of annual rental growth will be determined largely by the economic outlook, especially the rise in unemployment and the future path of average earnings.

“However, as new rental supply continues to catch up with demand levels, we could see further softening of headline rental growth by the end of the year, although there will be some areas of outperformance.

“Uncertainty continues over how any further outbreaks of COVID will impact the resumption of office life, student life and tourism, and this uncertainty will impact demand in some markets during the rest of the year.”

Source: Zoopla